Menu

Menu

Menu

Menu

We, Robot

Unlock the full potential of the automated robot and experience the algorithmic trading solution you've envisioned.

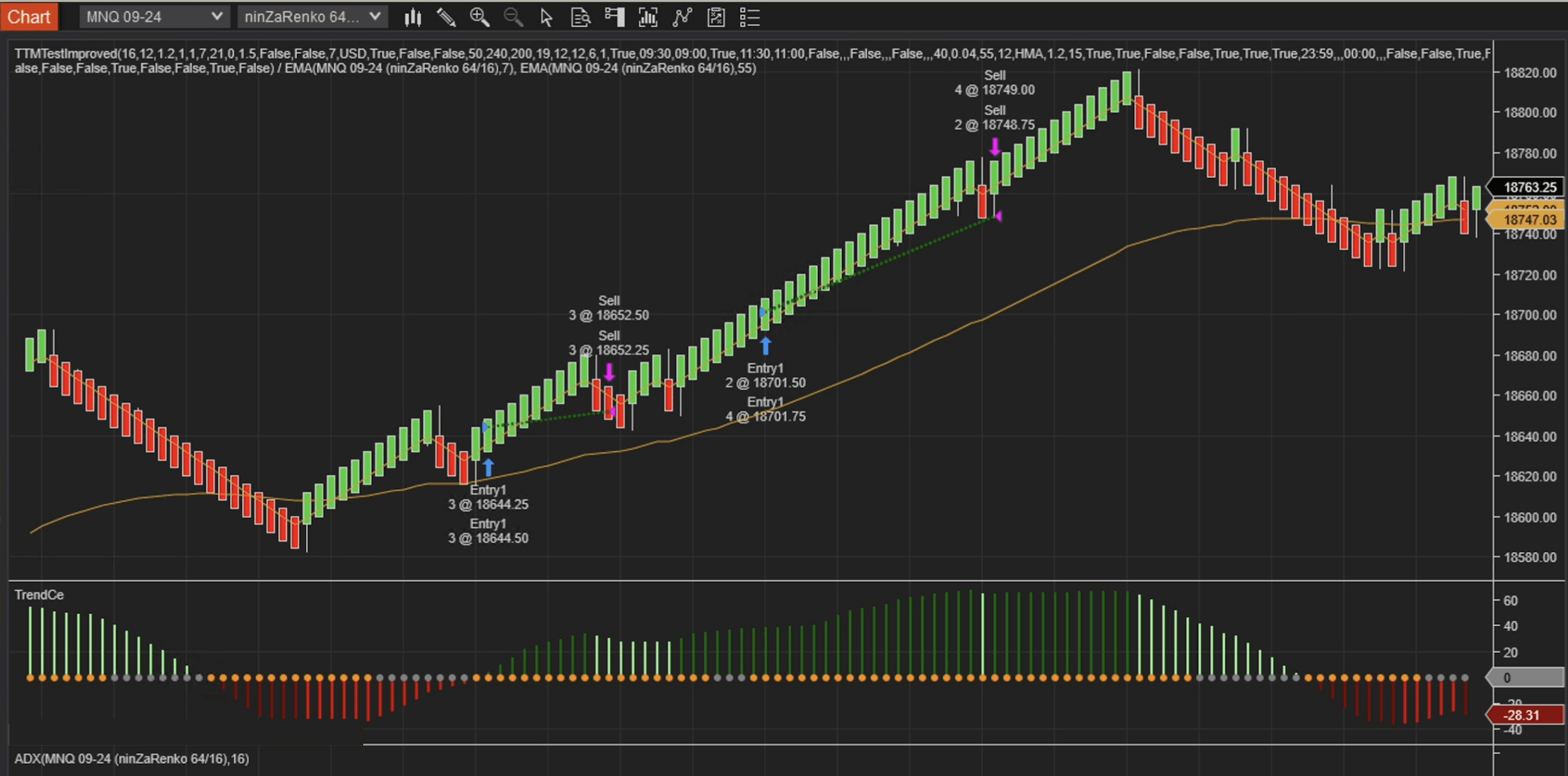

Real-time Market Analysis

Data Driven Trading System

Automation through Technologies

We, Robot

Unlock the full potential of the automated robot and experience the algorithmic trading solution you've envisioned.

Real-time Market Analysis

Data Driven Trading System

Automation through Technologies

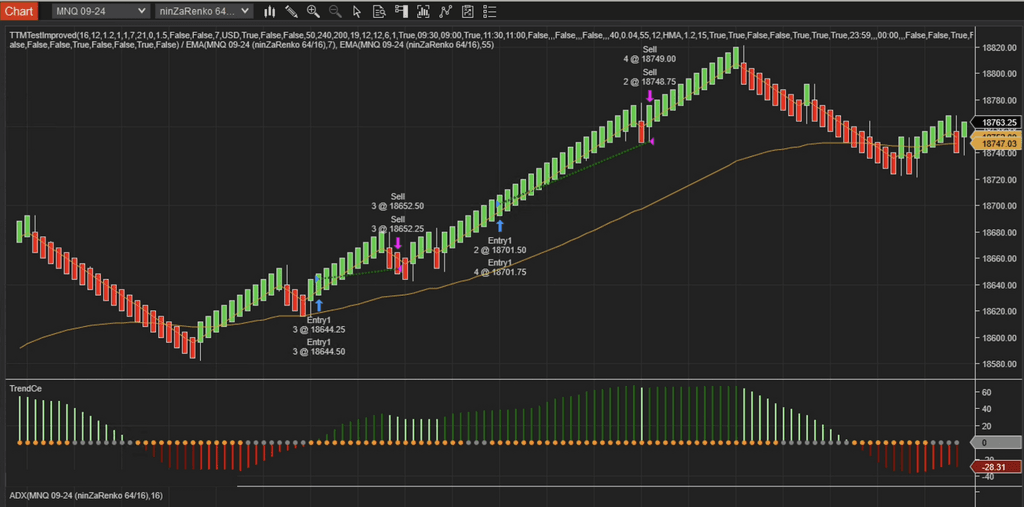

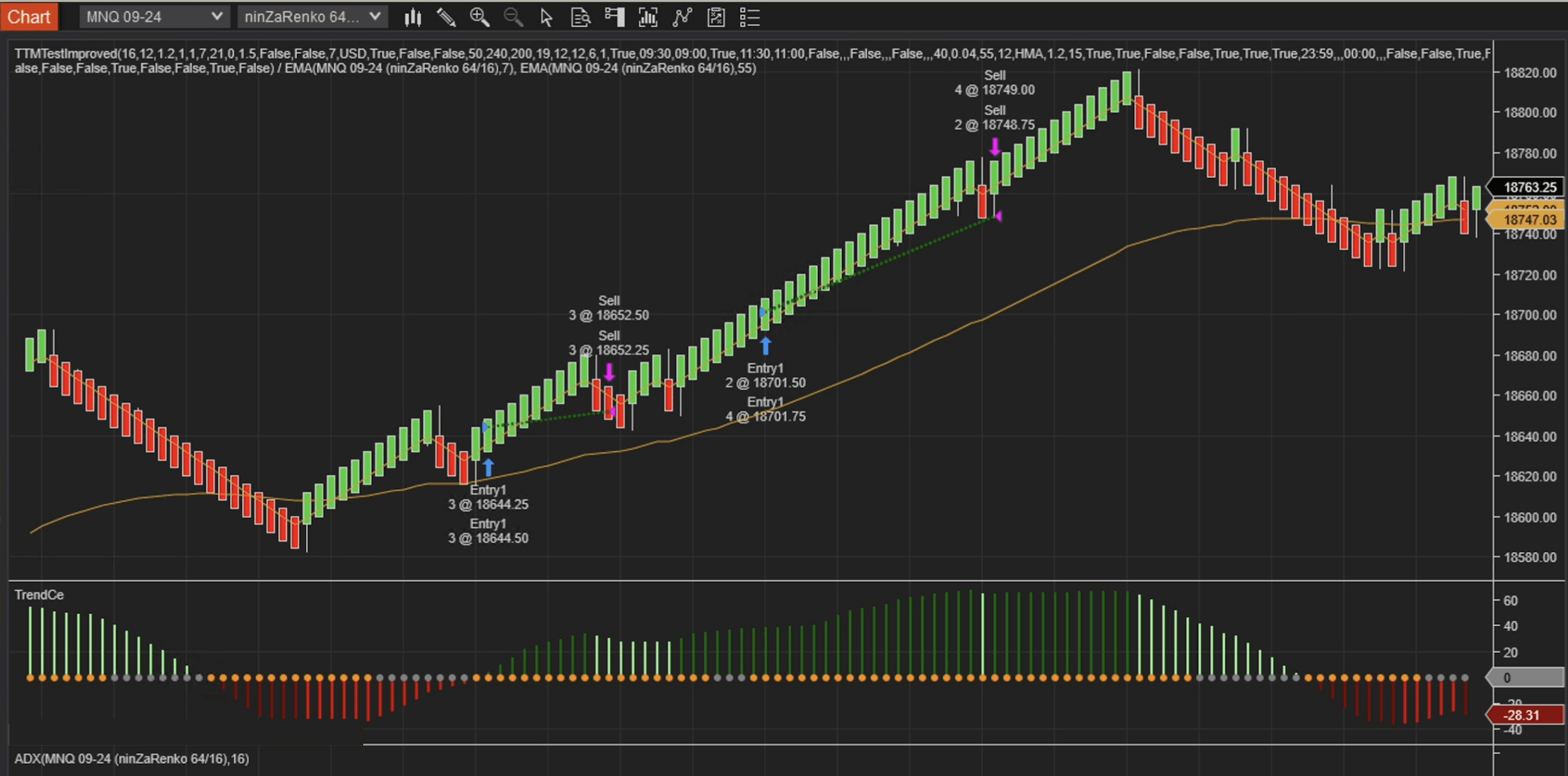

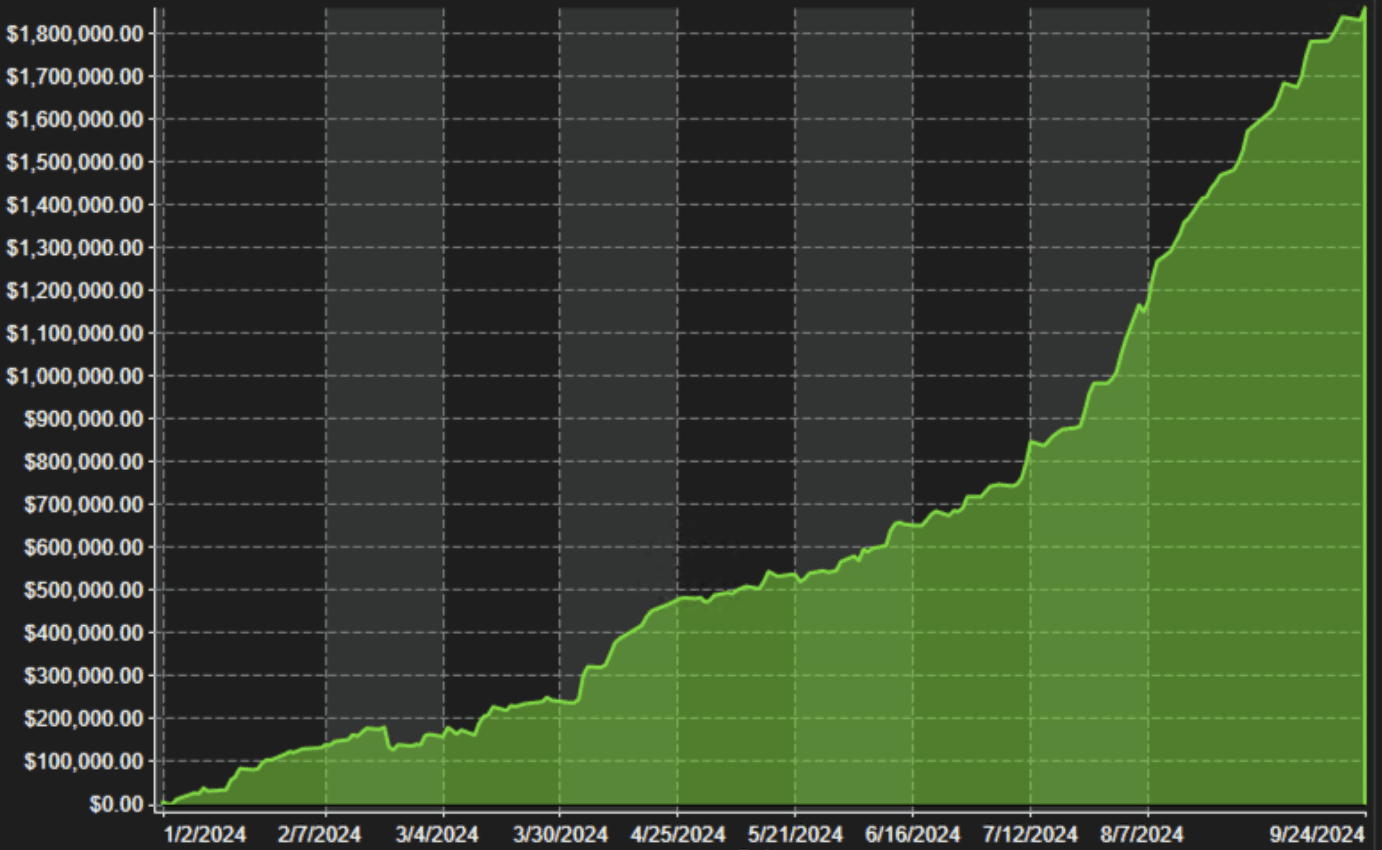

How we consistently outperform the market with automation.

1.5 ms

Trade Execution

Trade Execution

5.0 +

Profit Factor

Profit Factor

80% +

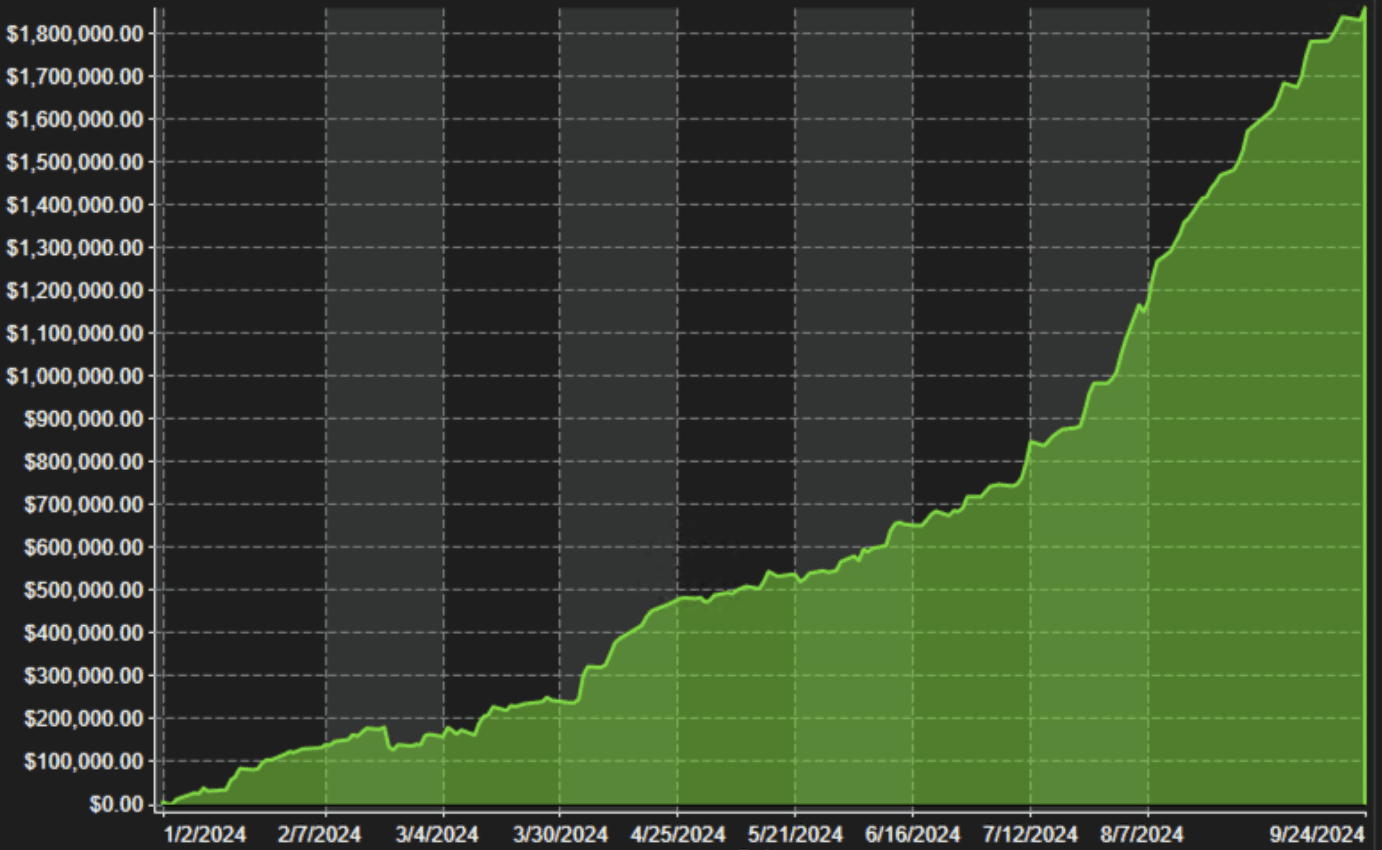

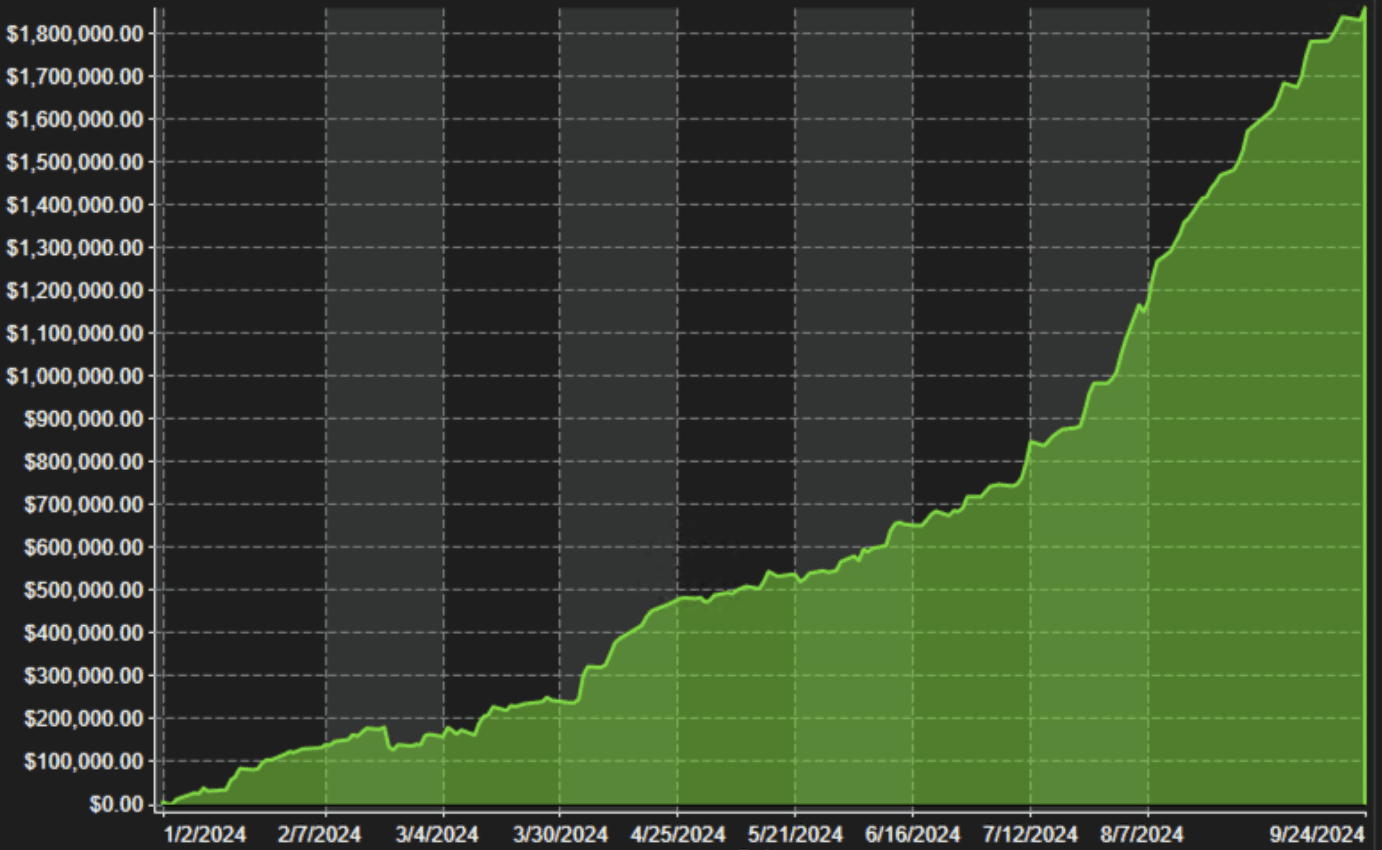

Yearly Return

Yearly Return

Real-Time Execution

Real-Time Execution

Seamlessly execute trades based on predefined parameters with precision and accuracy. Continuously scan market data for the best trading opportunities.

Seamlessly execute trades based on predefined parameters with precision and accuracy. Continuously scan market data for the best trading opportunities.

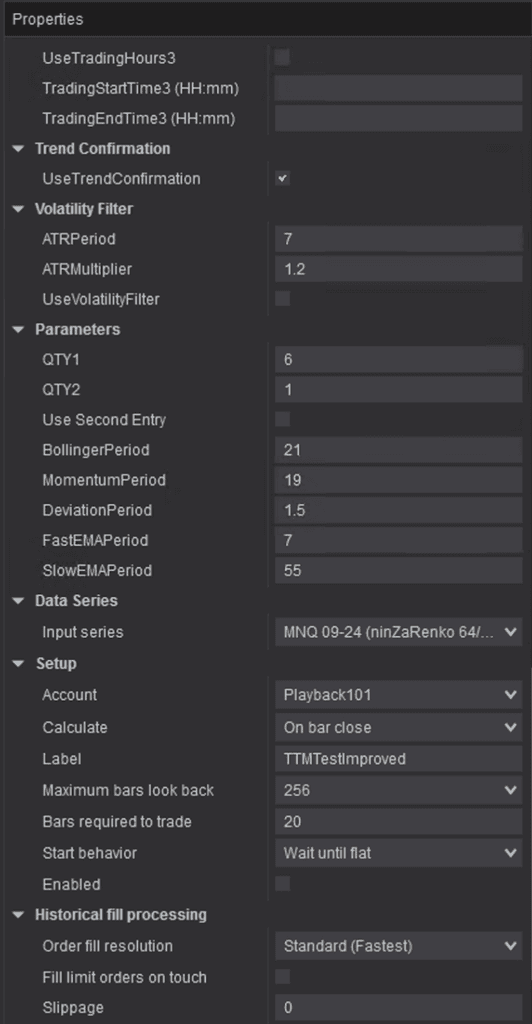

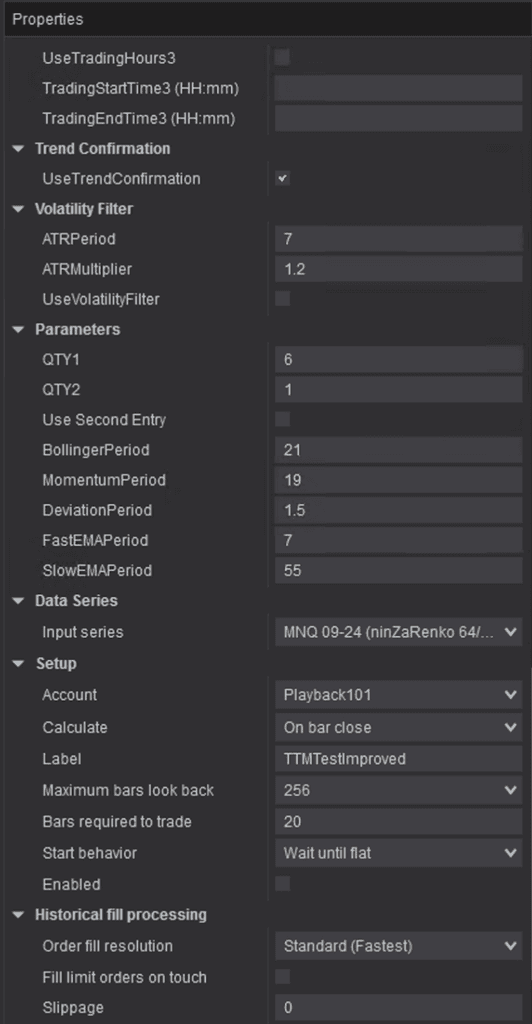

Customized Settings

Customized Settings

Tailor settings based on personal preferences or market conditions. Modify technical indicators to align with unique trading styles. Filter out trades during periods of consolidatoin.

Backtesting Capabilities

Backtesting Capabilities

Test strategies on historical data to optimize performance and minimize risk. Fine-tune trading strategies with strategy optimizer for better performance using various filters

Test strategies on historical data to optimize performance and minimize risk. Fine-tune trading strategies with strategy optimizer for better performance using various filters

Features of ModelCi

Features of ModelCi

01

Momentum

Measures the speed or velocity of price changes to determine the overall trend.

01

Momentum

Measures the speed or velocity of price changes to determine the overall trend.

01

Momentum

Measures the speed or velocity of price changes to determine the overall trend.

02

Bollinger Band

Measure volatility and identify overbought or oversold conditions in the market.

02

Bollinger Band

Measure volatility and identify overbought or oversold conditions in the market.

02

Bollinger Band

Measure volatility and identify overbought or oversold conditions in the market.

03

Keltner Channel

Identify breakout points and trends with average true range.

03

Keltner Channel

Identify breakout points and trends with average true range.

03

Keltner Channel

Identify breakout points and trends with average true range.

04

Fair Value Gap

Identify price imbalance within consecutive price bars during trending markets

04

Fair Value Gap

Identify price imbalance within consecutive price bars during trending markets

04

Fair Value Gap

Identify price imbalance within consecutive price bars during trending markets

05

ADX

Measures the strength of a trend on a scale from 0 to 100 to determine its direction.

05

ADX

Measures the strength of a trend on a scale from 0 to 100 to determine its direction.

06

Volume

Measures the total number of contracts traded during a specific period.

06

Volume

Measures the total number of contracts traded during a specific period.

07

Slope

Represents the rate of price change over time for strong or weak momentum.

07

Slope

Represents the rate of price change over time for strong or weak momentum.

08

Time

Control time of the day or day of the week to automatically excute and skip trades.

08

Time

Control time of the day or day of the week to automatically excute and skip trades.

Get Started with ModelCi

Feel free to sign up using the contact form below. We’ll respond promptly to address your message.

Feel free to sign up using the contact form below. We’ll respond promptly to address your message.

Support

Frequently Asked Questions

What is ModelCi and how does it help grow our accounts?

What is ModelCi and how does it help grow our accounts?

What is ModelCi and how does it help grow our accounts?

What instruments does ModelCi trade?

What instruments does ModelCi trade?

What instruments does ModelCi trade?

What risk management measures are in place?

What risk management measures are in place?

What risk management measures are in place?

What is the track record or performance history of ModelCi?

What is the track record or performance history of ModelCi?

What is the track record or performance history of ModelCi?

How do you handle ongoing maintenance and updates?

How do you handle ongoing maintenance and updates?

How do you handle ongoing maintenance and updates?

Can we run a proof of concept before fully committing?

Can we run a proof of concept before fully committing?

Can we run a proof of concept before fully committing?